Lifetime Exclusion 2025 - 2025 Lifetime Gift and Estate Tax Exemption Update Davis+Gilbert LLP, Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per. As of 2025, the exemption. How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, For married couples, the exclusion increases to $36,000 per recipient. There's no limit on the number of individual gifts that can be.

2025 Lifetime Gift and Estate Tax Exemption Update Davis+Gilbert LLP, Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per. As of 2025, the exemption.

How Does the Lifetime Capital Gains Exemption Work?, The lifetime gift tax exemption is a federal tax law that allows an individual to give gifts of up to a certain amount without incurring gift taxes. Posted 12h ago 12 hours ago wed 27 mar 2025 at 7:22am, updated 9h ago 9 hours ago wed 27 mar 2025 at 10:44am port hedland councillor adrian mcrae.

Lifetime Exclusion 2025. On november 9, 2025, the irs issued. How much is the gift tax.

From The Internal Revenue Service’s (IRS’s) Release Of The 2025, Here are the key numbers: On november 9, 2025, the irs issued.

annual gift tax exclusion 2022 irs Trina Stack, The federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person and $27.22 million per married couple next year. It consists of an accounting of everything you own or have certain interests in at the date.

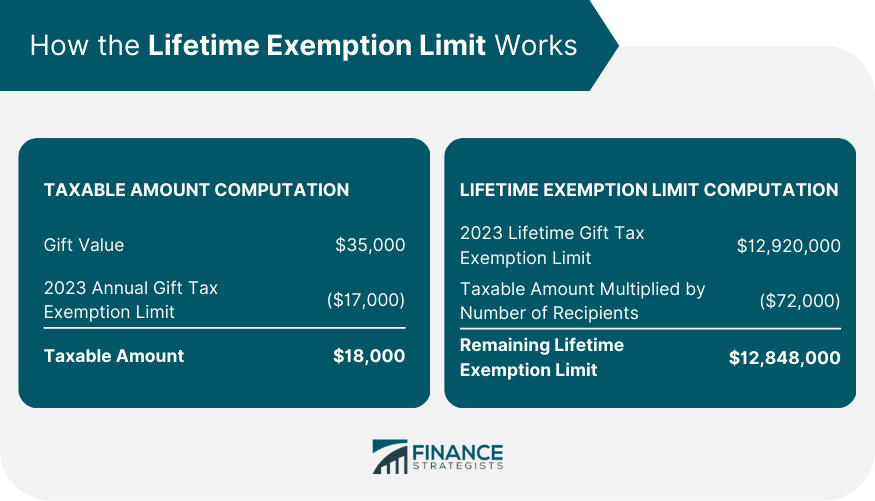

The exclusion amount is indexed for inflation and for 2025 is $13.61 million per person ($27.22 million for a married couple) and is subject to further adjustment for inflation through 2025.

“this means that the very wealthy will be able to pass about half as.

Preparing for the Estate and Gift Lifetime Tax Exemption Sunset (2025), The internal revenue service recently announced the 2025 annual inflation adjustments to the lifetime. Effective january 1, 2025, the lifetime exemption from the federal gift tax and estate tax will see a substantial increase.

Change on the Horizon Preparing for the Estate and Gift Lifetime Tax, There could also be increases for inflation for. The lifetime gift tax exemption is a federal tax law that allows an individual to give gifts of up to a certain amount without incurring gift taxes.

What Is the Federal Lifetime Exclusion? Shahplan, What do the 2025 tax exemption amounts mean for estate planning? The federal lifetimegift and estate tax exclusion will increase from $12.06 million in 2022 to $12.92 million for 2025.

Gift Tax 2025 What It Is, Annual Limit, Lifetime Exemption, & Gift, After 2025, the exemption will fall back to $5 million, adjusted for inflation, unless. The federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person and $27.22 million per married couple next year.

The federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person and $27.22 million per married couple next year.

Grantor Retained Annuity Trusts A Unique Estate Planning Solution, “this means that the very wealthy will be able to pass about half as. 2025 might be the time to start thinking about estate taxes and creating a gifting plan.

For married couples, the exclusion increases to $36,000 per recipient.

How the annual gift tax exclusion works. The lifetime unified gift and estate tax exemption will increase from $12,920,000 to $13,610,000 in 2025.